Download Analyst Report

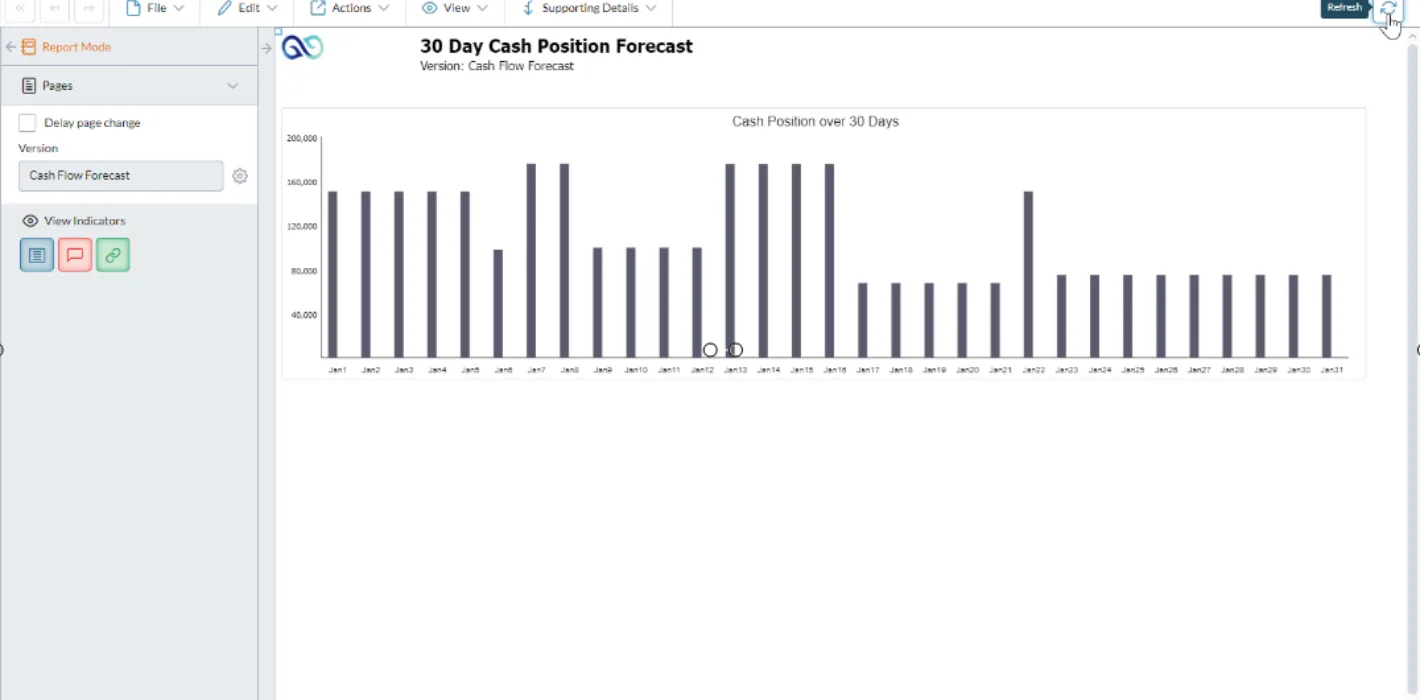

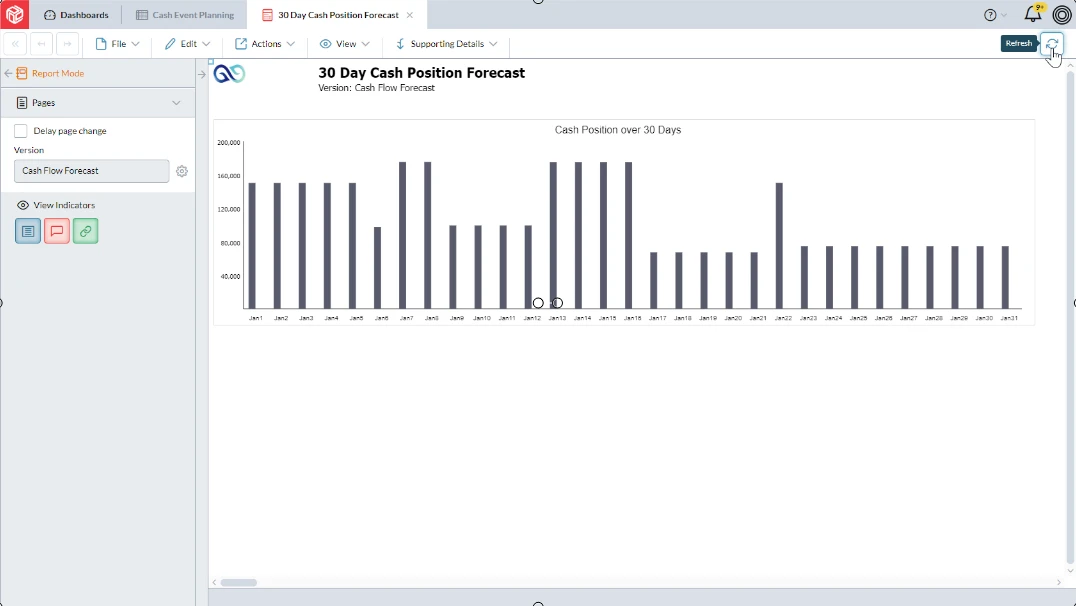

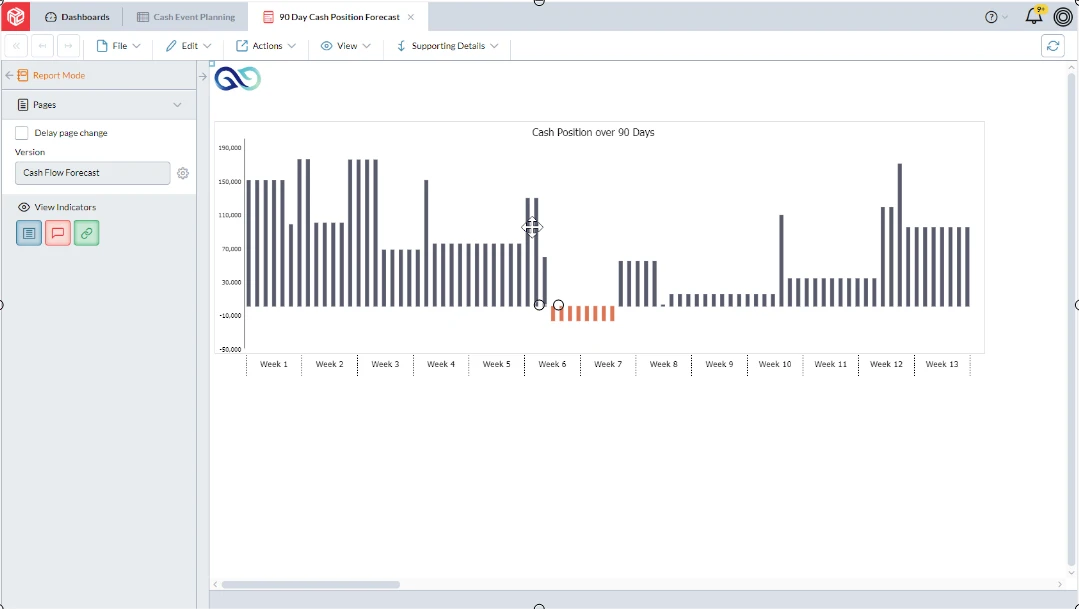

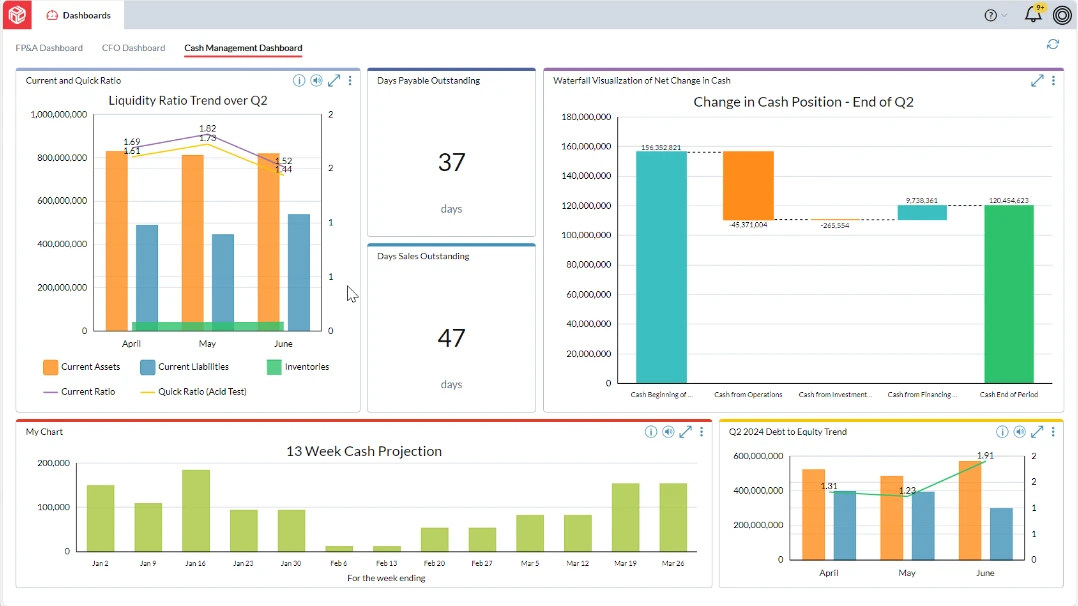

Cash Flow Planning

Ensure sufficient working capital with reliable cash flow planning.

Tags

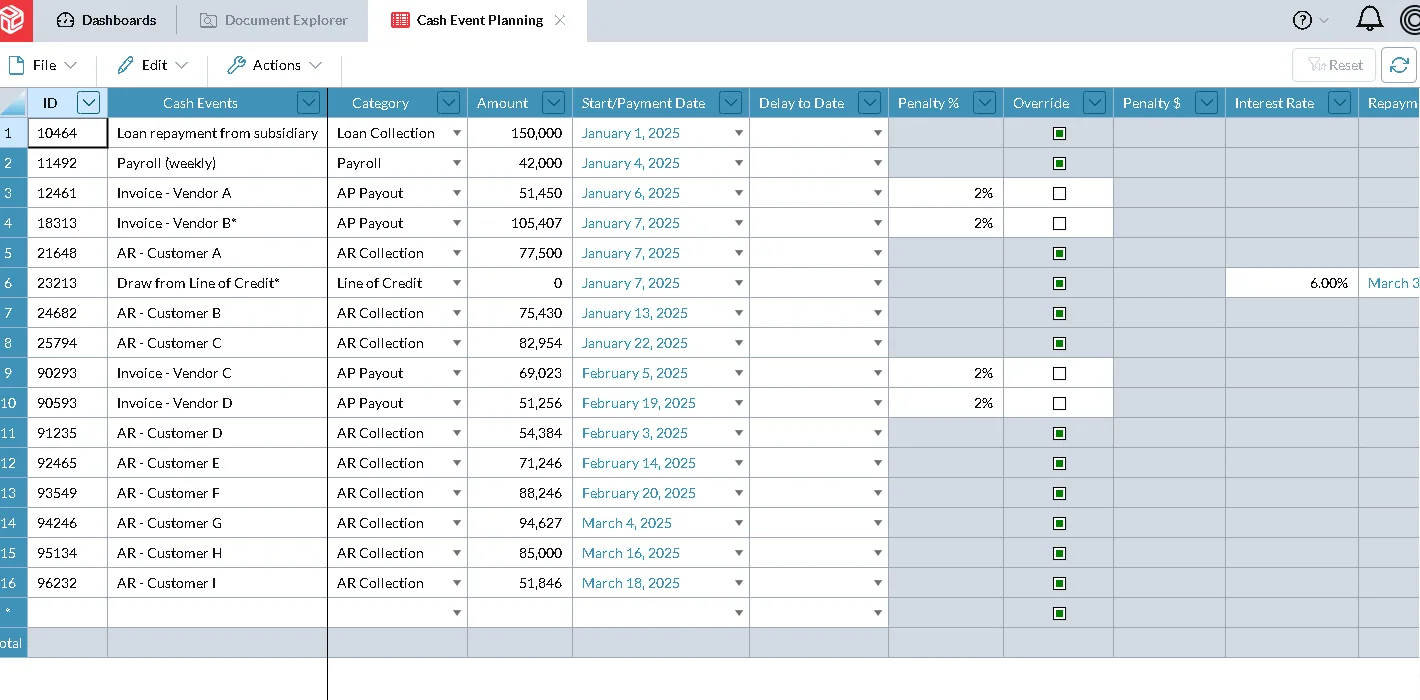

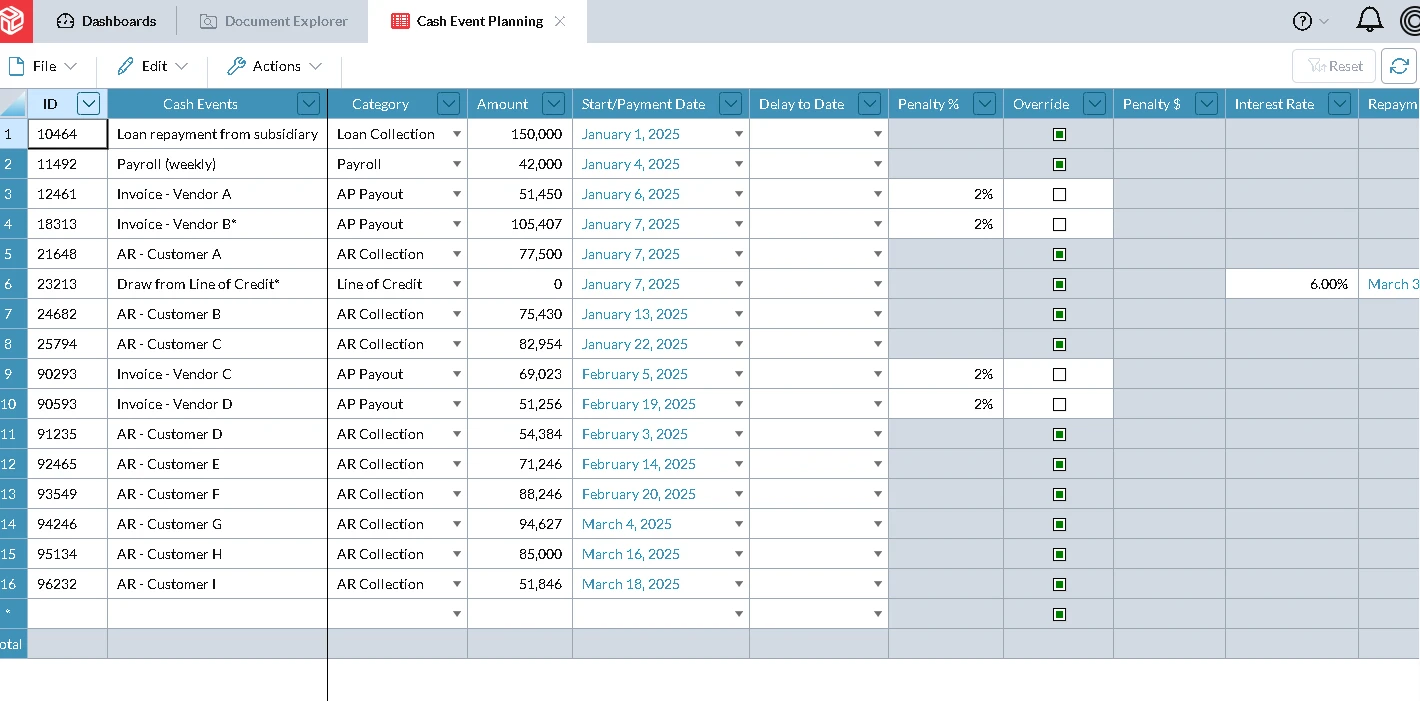

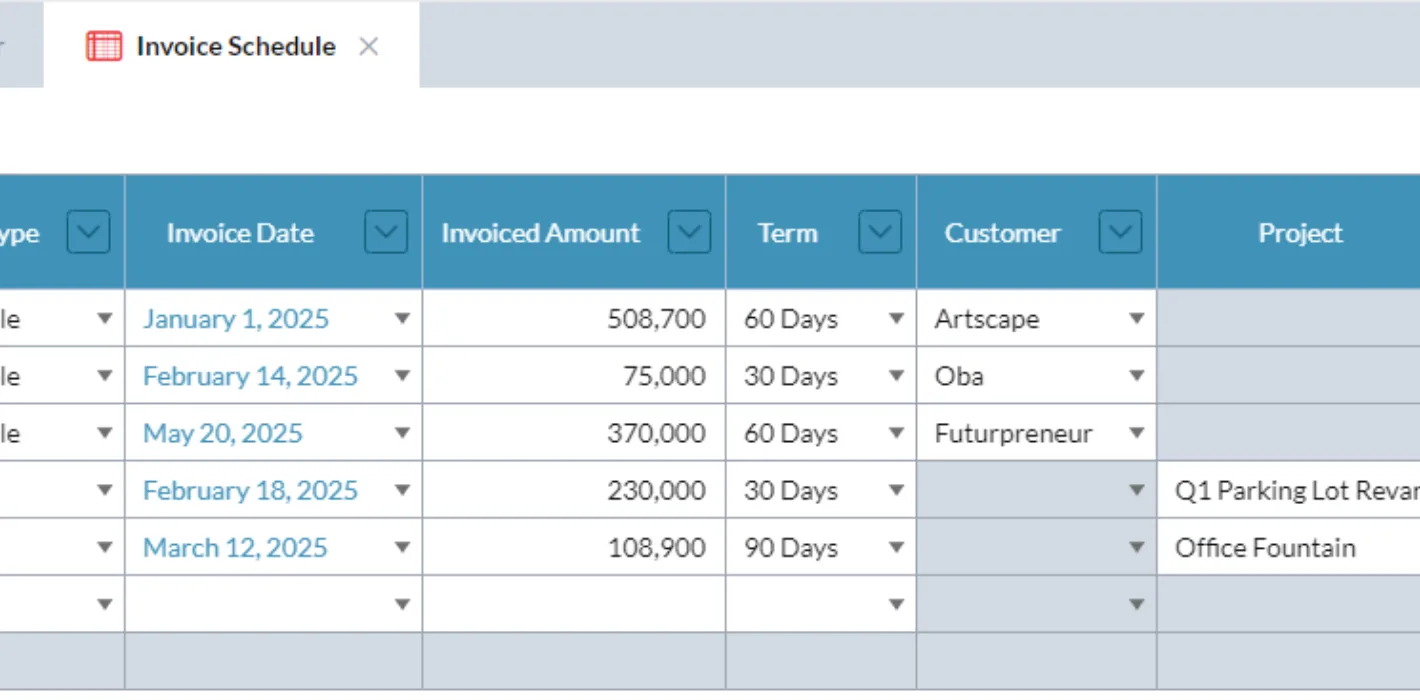

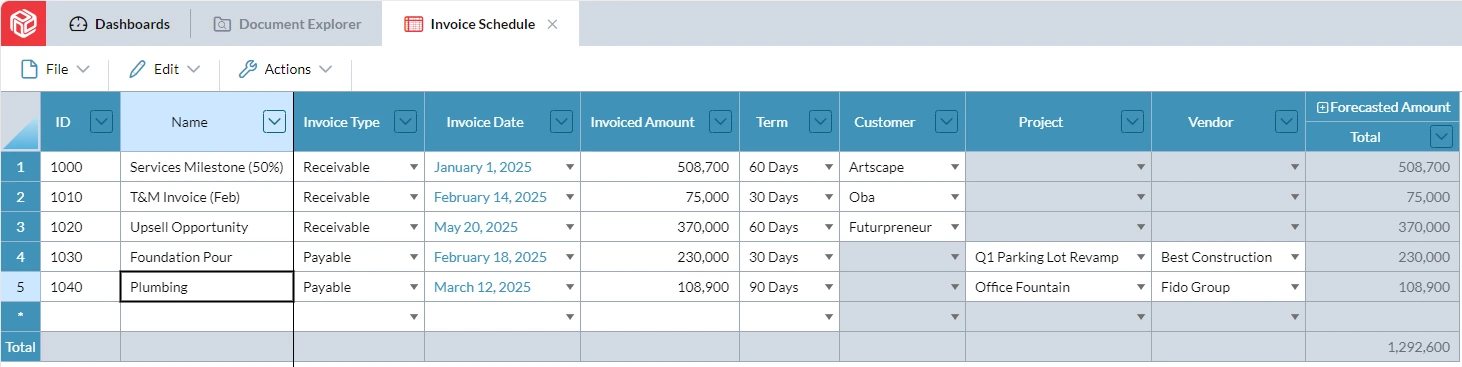

Accurate cash flow planning is essential for keeping day-to-day operations on track and supporting sustainable, long-term growth. Set client credit terms strategically and manage payments to minimize interest expenses, ensuring both accounts receivable(A/R) and accounts payable(A/P) are balanced to maintain healthy cash flow.

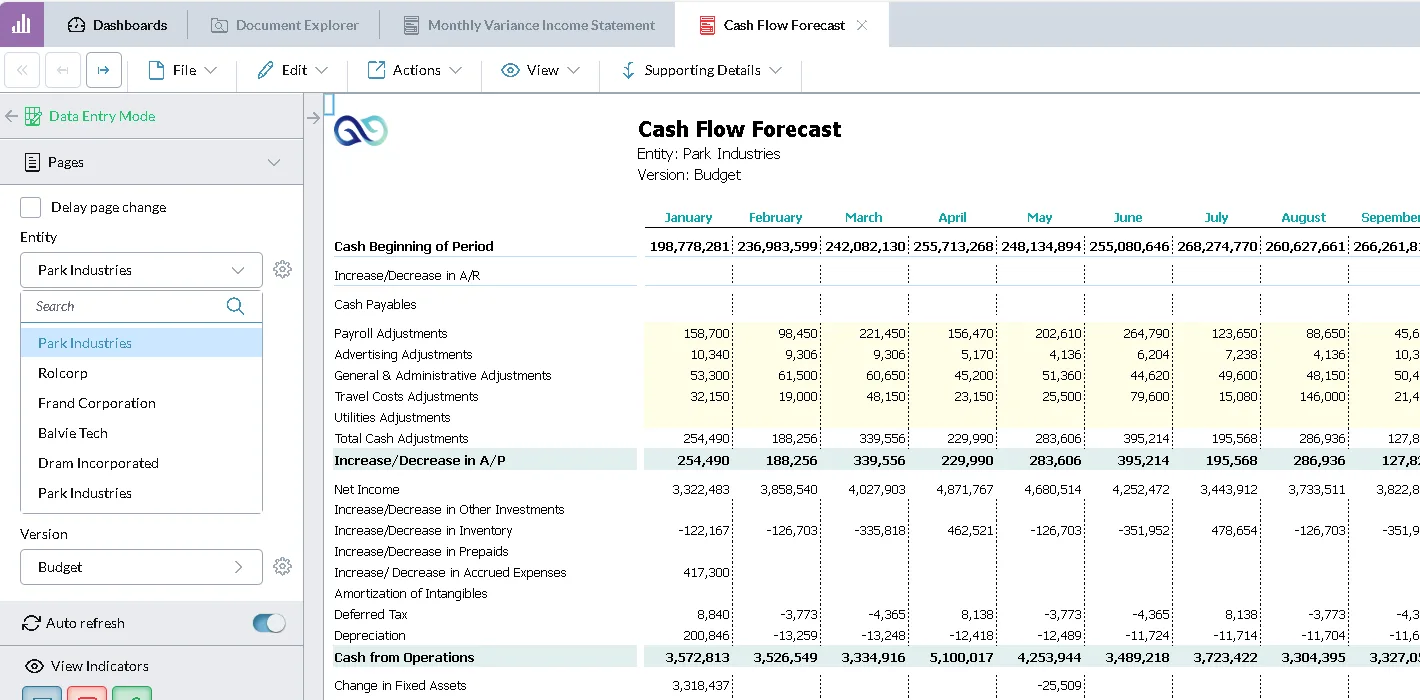

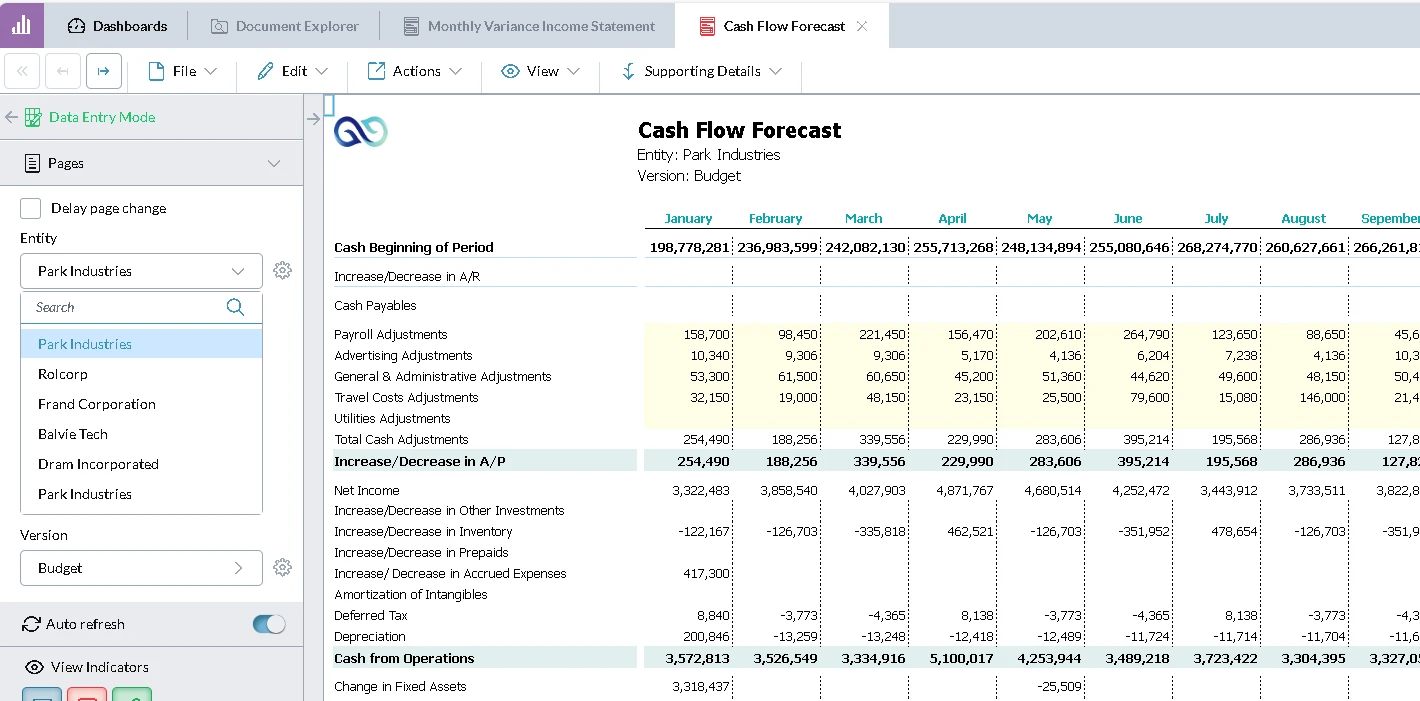

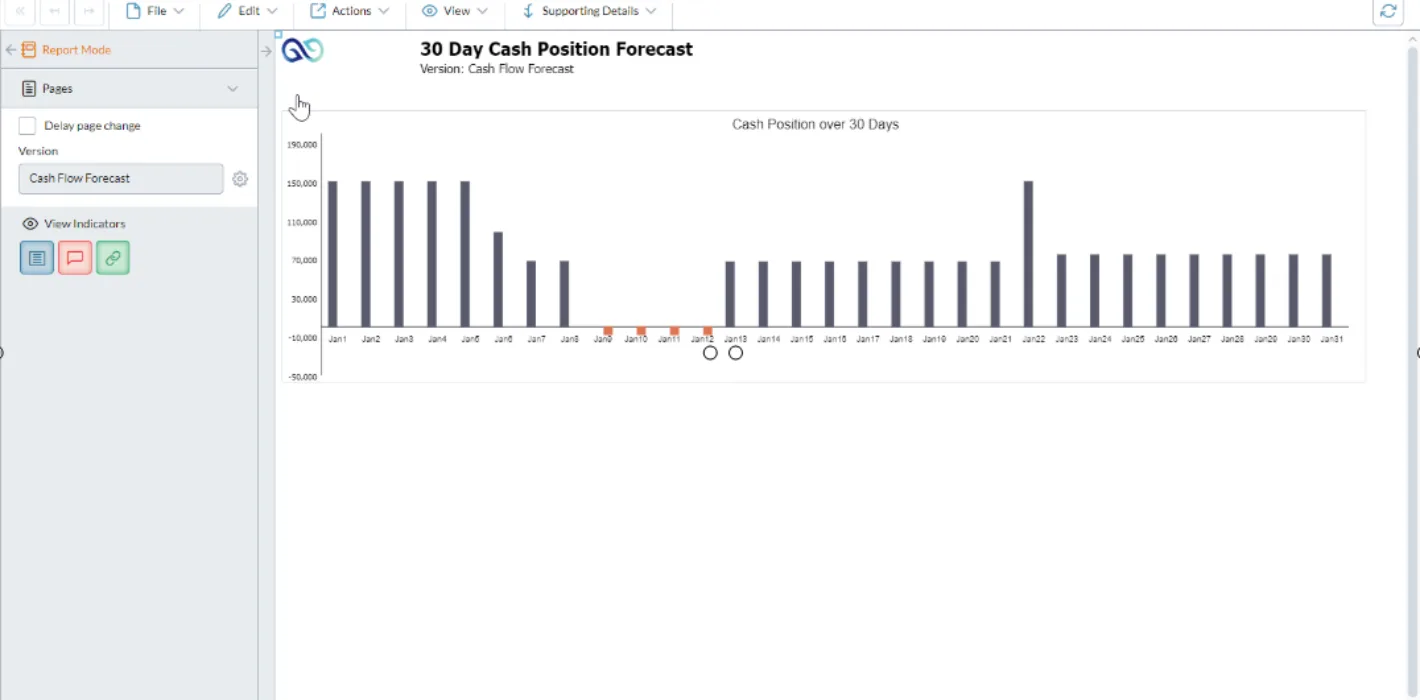

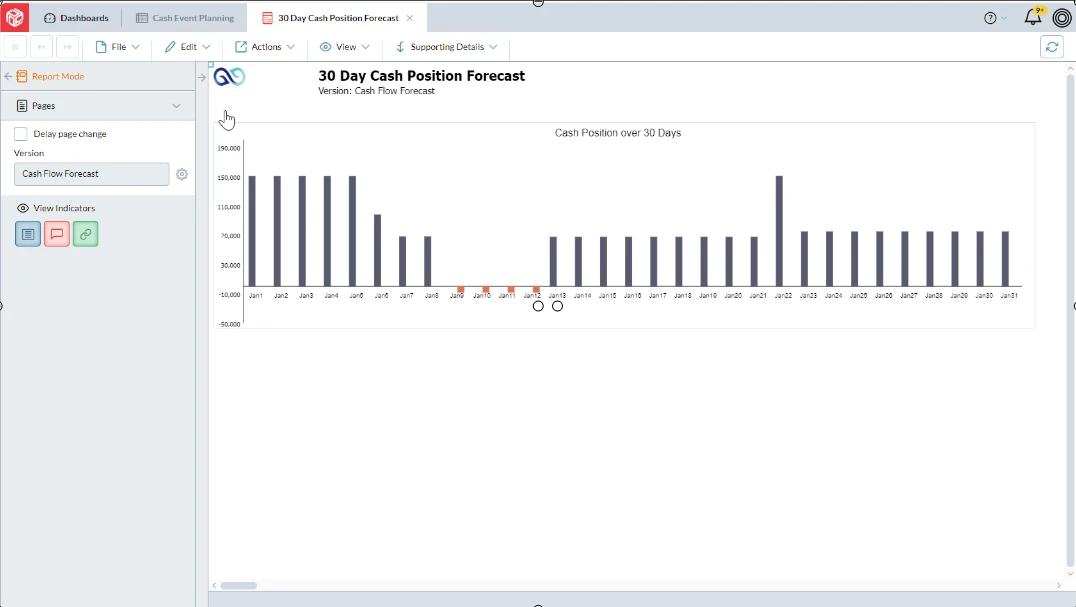

Reliable cash flow planning with Prophix One FP&A Plus supports financial health by preventing liquidity shortages, preventing missed payment deadlines, and mitigating risks such as over-leveraging or cash crunches during critical periods.

Integrate revenue and expense data, payment cycles and capital expenditures, and key assumptions like payment terms and seasonal trends to develop a comprehensive cash flow plan. Align your finance and operations teams to improve cash management, ensure adequate working capital, and mitigate risks like late payments, missed opportunities, or unplanned borrowing.

FP&A Plus simplifies cross-departmental collaboration with its robust collaboration features. Safeguard your business’s financial lifeline by anticipating cash shortages, optimizing payment schedules, and ensuring that your company responds swiftly to market changes while staying on track to meet financial goals.